United Way of St. Johns County’s RealSense program has partnered with the Internal Revenue Service (IRS) to provide free, confidential, and secure tax preparation by certified tax preparers. To qualify, taxpayer’s household income must have been $79,000 or less in 2023.

Tax season doesn’t have to be complicated. United Way of St. Johns County offers this service at locations throughout Putnam and St. Johns Counties through the Volunteer Income Tax Assistance (VITA) Program. If you would like to become a VITA Volunteer please click here or email freetaxprep@unitedway-sjc.org.

File Taxes Yourself – If you feel comfortable preparing your own tax return, myfreetaxes.com is available 24/7 for self-filing at no cost. Phone, email and chat support is available to answer any questions you might have during your filing process.

If you are concerned about the status of your refund, please visit IRS: Where’s My Refund.

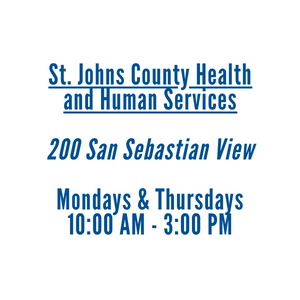

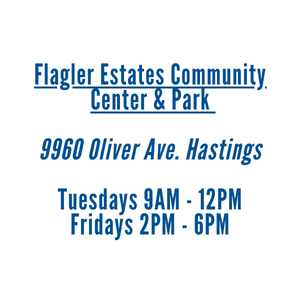

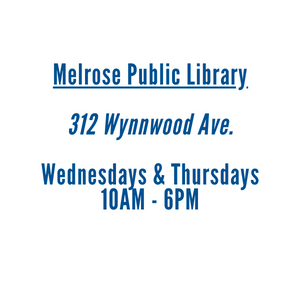

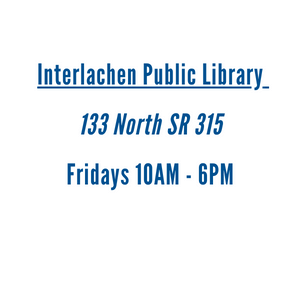

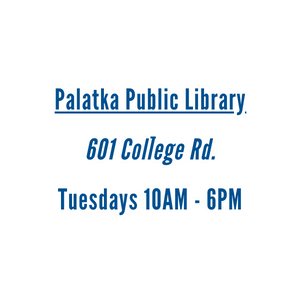

Filed For You – Face-to-face tax preparation are offered at various locations in Putnam & St. Johns County. Please scroll down for our 2024 locations!

To book your free tax prep appointment, click here!

If you need to cancel OR reschedule your appointment time, please email freetaxprep@unitedway-sjc.org

REQUIRED:

Social Security Number (SSN) card or letter

Adoption Taxpayer Identification Number (ATIN) card or letter

Individual Taxpayer Identification Number (ITIN) card or letter

Previous year’s tax return

All W-2s for current tax year

Joint returns require both filers to be present to sign the return

Voided check or account number card to direct deposit your refund (This is optional, but allows you to get your refund fast)

INTERVIEW/INTAKE SHEET – click to download

Please fill out the intake sheet and have it ready along with the required documents prior to your visit. You may arrive 15 minutes early to your scheduled appointment to fill out the Intake form prior to your appointment.

DIRECT DEPOSIT INFORMATION – Using direct deposit is the safest and fastest way to receive your tax refund and economic impact payments. You will need an account number and a routing number from a bank or a credit union to set up a direct deposit.You may also go to the IRS Website for more information about your refund and direct deposit.

If married, filing jointly, BOTH parties must be present.

IF APPLICABLE:

Form 1099-DIV, G, INT, Q, R, RRB, SSA for the current tax year

If you have child care or dependent care expenses, please bring the name, address, and tax ID or SSN/ITIN of the care provider

Form 1098-T or 1098-E for educational expenses

Form 1095 Affordable Care Act